State Of California Employment Development Department Tax Lien

The EDDs tax lien is a perfected and enforceable state tax lien on all property and rights to property whether real personal tangible or intangible including all subsequently acquired property and rights to property belonging to the taxpayer. The Employment Development Department EDD administers Californias payroll taxes including Unemployment Insurance Employment Training Tax State Disability Insurance including Paid Family Leave and California Personal Income Tax withholding.

How To File A California Mechanic S Lien 3 Basic Steps Mechanic Learn Pinterest California

If the taxpayer does not respond FTB.

State of california employment development department tax lien. State Tax Lien DE 631TL PDF. Log In or Enroll. California Relay Service 711.

For more information view Information Sheet. A legally enforceable right to keep the property of a business until its tax debt obligations have been satisfied. Employment Development Department Accounts Receivables for States Employment Tax Program Introduction As one of the nations largest tax collection agencies the Employment Development Department EDD handles the audit and collection of employment taxes for over 13 million employers and maintains employment records for over 17 million California workers.

FTB may record a lien against taxpayers when their tax debts are overdue. A lien expires 10 years from the date of recording or filing unless we extend it. Board of Equalization 916 445-1122.

The EDD may record a lien against a delinquent taxpayer. The statute states the following. The Employment Development Department EDD is authorized to file with the Secretary of State and record with any county recorder a Notice of State Tax Lien specifying the amount of contributions interest penalties and costs due to the EDD.

California Secretary of State. A tax lien is a public notice of liability that specifies the amount of tax and any associated fees such as penalties or interest. FTB notifies taxpayers 30 days before recording the lien.

The EDD State Tax Lien. For questions about a state tax lien contact the appropriate agency directly. As Staff Tax Auditor Employment Development Department at State of California Lien T Chieng made 84034 in total compensation.

The program consists of Unemployment Insurance and Employment Training Tax which are employer contributions and Disability Insurance and Personal Income Tax which are withheld from employees. Liens enable further enforced collection actions and are lifted only when the associated liability. A stop notice mechanics lien under California law has a priority over Notice of Levy under California Civil Code 3193 meaning that a proper filing of mechanics lien under state law will override EDDs Notice of Levy.

Section 1703 of the California Unemployment Insurance Code provides. STATE TAX LIEN The Employment Development Department EDD is authorized to ile with the Secretary of State and record with any county recorder a Notice of State Tax Lien specifying the amount of contributions interest penalties and costs due to the EDD. Section 1703 of the California Unemployment Insurance Code provides.

Submit view and manage Work Opportunity Tax Credit WOTC Request for Certification Applications. This information is according to State of California payrolls for the 2014 fiscal year. This Google translation feature provided on the Employment Development Department EDD website is for informational purposes only.

Employment Development Department Tax Lien Before a quality and employment development department Many tax liens and pay what option of th. When you owe tax debt we automatically have a statutory lien that attaches to all California real or personal property you own or have rights to. California state tax liens are recorded at the request of various governmental agencies.

Common state and federal agencies include. An official examination of the payment history of a registered business legally required to make periodic tax payments. This secures and protects the debt owed to us and notifies creditors of the debt.

Representatives are available 8 am. To contact a Payroll Taxes representative or to use the Automated Phone Information System. Employers conducting business in California are required to register with and file reports and pay taxes to EDD.

The EDD may record a state tax lien against employers who do not file required returns and pay liabilities on time. If we extend the lien we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State. Manage your employer payroll tax accounts.

Provide the Payroll Tax Assistance number 1-888-745-3886 to the operator. Respond to Notice of Unemployment Insurance Claim Filed DE 1101CZ. The EDD is authorized to file with the office of the Secretary of State and record with any county recorder a Notice of State Tax Lien specifying the amount of taxes interest penalties and cost due the EDD.

In State Fiscal Year. What it does do is place the EDDs interest in the business assets before. If you dont respond to our letters pay in full or set a payment plan we may record andor file a Notice of State Tax Lien against you.

Each agency provides their own documentation to resolve liens. Lien T Chieng total compensation is 5 higher than average. California Department of Tax and Fee Administration.

Employment Development Department 916 464-2669. Any discrepancies or differences created in the translation are not binding and have no legal effect for. Money that must be paid to a federal state or local government.

Pacific time Monday through Friday except on state holidays. Or a Notice must be served within ten years from the recording of a judgment or the filing of a Notice of State Tax Lien. A If any employer or other person fails to pay any amount due to the EDD at the.

The web pages currently in English on the EDD website are the official and accurate source for the program information and services the EDD provides. Of this total 62770 was received as a salary 21264 was received as benefits. The lien does not allow the EDD to seize a business assets.

CUIC 1703 is the primary statute dealing with EDD liens. Lien T Chieng Salary Overview.

Edd Audit Advice What Is The California Edd Audit Statute Of Limitations

Application For Trade Adjustment Assistance Taa California Assistant Application

Edd Edd Collections Rjs Law California Payroll Tax Lawyers

Https Www Edd Ca Gov Pdf Pub Ctr De44 18 Pdf

Employment Development Department Edd Tax Lien What Next

Employment Development Department Edd Tax Lien What Next

How To Handle An Edd Lien Brotman Law

Employment Development Department Edd Tax Lien What Next

California Edd Notice Of Levy Brotman Law

Https Savvysassymoms Com Wp Content Uploads 2013 06 2011 Bills 4 Pdf

Hop On Inc Hpnn State Tax Lien Renewed 2017 Now 41 423 But Actually

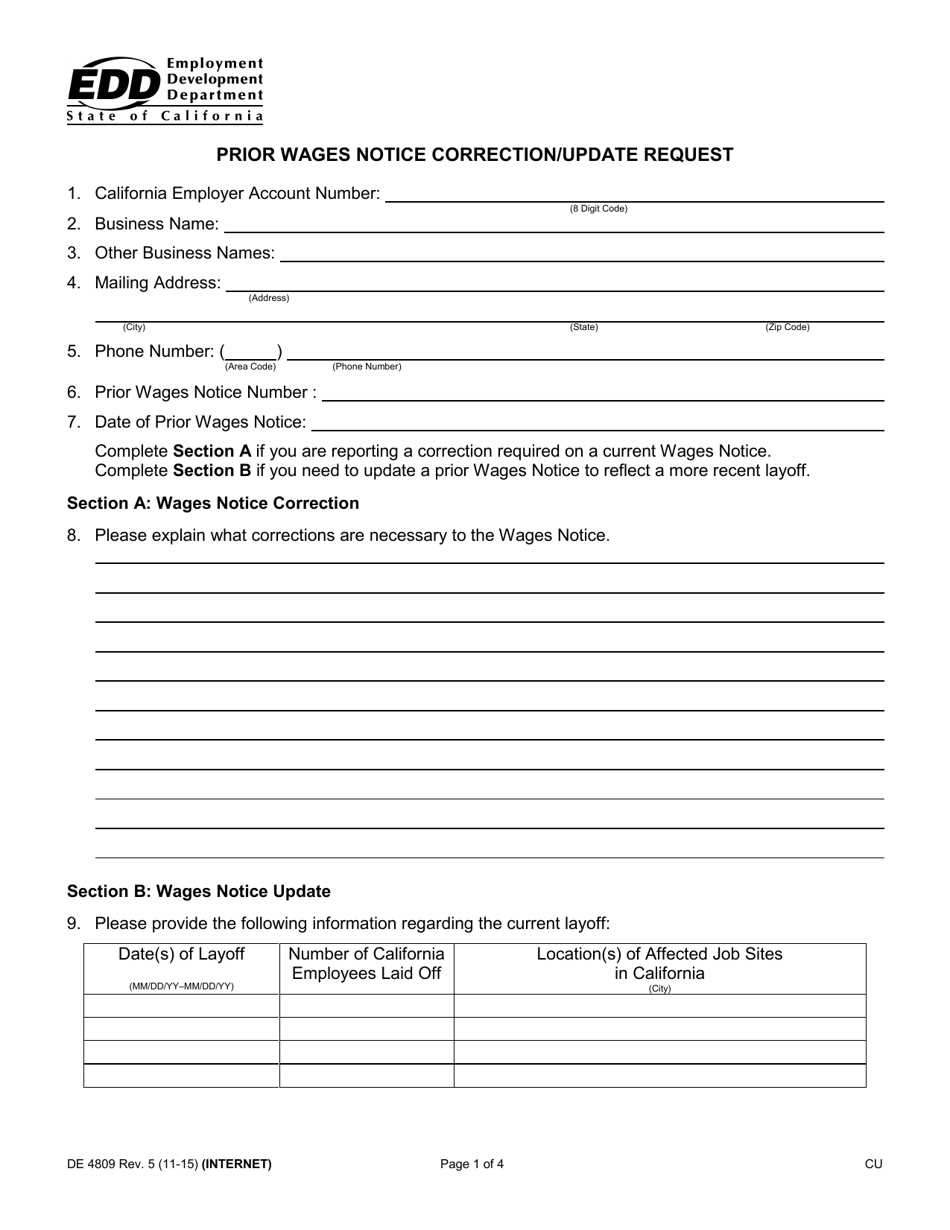

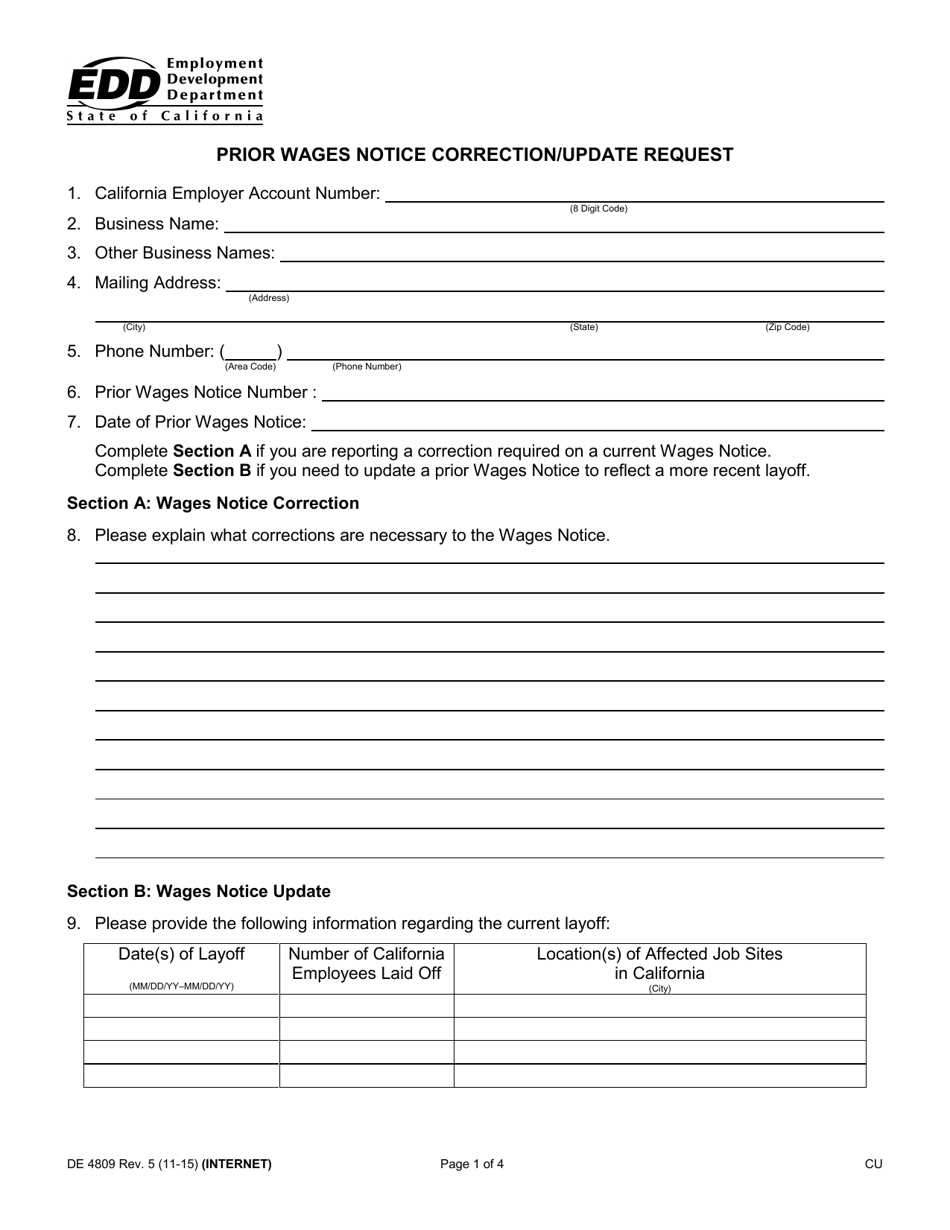

Form De4809 Download Printable Pdf Or Fill Online Prior Wages Notice Correction Update Request California Templateroller

Boy Tax Lien Termination Dailyemerald Com

Https Edd Ca Gov Pdf Pub Ctr De999a Pdf

2 Ca State Senators Seek To Keep Edd Phone Lines Open 24 7 Amid Long Processing Delays Ktla

How Does The Employee Development Board Handle Tax Liens Brotman Law

Https Edd Ca Gov Pdf Pub Ctr De631p Pdf

Posting Komentar untuk "State Of California Employment Development Department Tax Lien"