Colorado Employment First Exemptions

The Economic Policy Institute strongly encourages CDLE to use its authority to increase the Colorado salary threshold for the EAP exemption from overtime and follow the example of the Washington State DOL by setting the Colorado threshold at 25 times the state minimum wage11 Because Colorados minimum wage is set to rise to 12 per hour in 2020 this would set the salary. Eligibility for some benefits may depend on residency military.

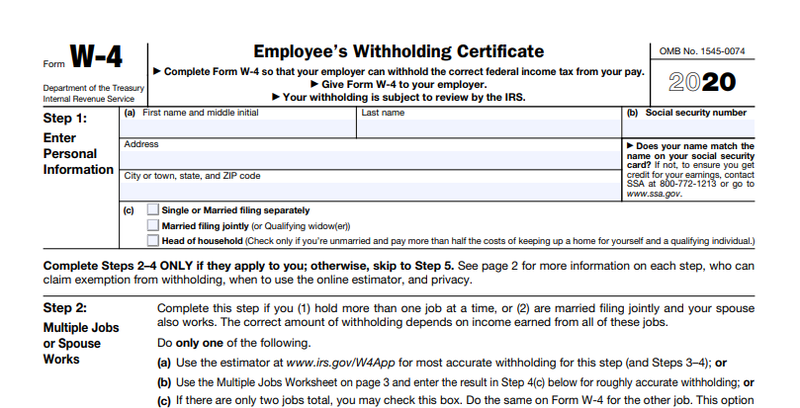

How To Fill Out A W 4 Form Without Errors That Would Cost You Employee Tax Forms Tax Forms Job Application Form

The IRS will automatically refund money to people who already filed their tax return.

Colorado employment first exemptions. To be eligible you must be a SNAP recipient. Parents of students in preschool or child care must submit nonmedical exemptions at 2 4 6 12 and 18 months of age. No because pay stubs do not usually have the employers FEIN on them.

The bill allows an aggrieved employee or applicant for employment to file a civil action for injunctive affirmative and equitable relief and if the employer or health facility acted with. When there is no FEIN with the income tax filing or the FEIN is incorrect the taxpayer will be required to communicate. The Colorado Department of Revenue verifies the FEINs to ensure the employer has paid the taxpayers withholding tax.

Any employee working in the State of Colorado is covered by the protections of the Colorado Anti-Discrimination Act CADA. The HFWA also requires employers to provide employees with up to 80 hours of paid sick leave upon the declaration of a public health emergency. Secretary of Labor Thomas E.

It can also figure into qualifying homeowners decision on whether to stay or sell since the. Colorado law provides that upon separation of employment an employer must pay an employee all vacation pay earned and determinable in accordance with the terms of any agreement In June 2019 the Colorado Court of Appeals held that an employer may place restrictions on payment of accrued but unused vacation pay at separation as part of its policies or agreements. Technically the tax break allows homeowners to deduct 50 of the first 200000 of appraised value.

Hier sollte eine Beschreibung angezeigt werden diese Seite lsst dies jedoch nicht zu. Per Colorado Revised Statutes 25-4-2403 immunizing providers who sign the Certificate of Nonmedical Exemption must submit nonmedical exemption data to CIIS. This tax credit encourages businesses to provide a qualified health insurance plan to employees potentially improving community health and reducing public.

The state of Colorado is not currently pursuing any mandates. 38-41-204 - Spouse or child of a deceased owner can also qualify for homestead exemption. Teachers and staff will be exempt if they have religious or medical reasons.

The American Rescue Plan a 19 trillion Covid relief bill. Exemptions Rules Statutes Department of Local Affairs. Colorado Employment First promotes self-sufficiency and independence by preparing Supplemental Nutrition Assistance Program SNAP recipients for employment through job-seeking skills training work experience and monthly job-search support activities.

Territories urging them to adopt policies and practices that promote the employment of people with significant disabilities in integrated settings earning at or. Employers may be able to require COVID-19 vaccination for in-person work for their employees but an employee may be entitled to an exemption through the ADA and Civil Rights Act of 1964. The bill prohibits an employer including a licensed health facility from taking adverse action against an employee or an applicant for employment based on the employees or applicants COVID-19 immunization status.

Independent Contractors and individuals in the domestic service of any person eg a personal nanny or housekeeper are not employees as defined by CADA. Letter to Governors on Employment First PDF On July 22 2015 then US. Beginning in 2022 employers of all sizes will have the same mandate.

The FEIN is required when taxpayers file their income tax whether electronically or on paper. The law also creates notice requirements for employers and allows employees. In Colorado where the median home price exceeds 500000 that break easily fits most long-term homeowners in the states hottest areas and can reduce their tax bill by hundreds of dollars.

A waiver on the first 10200 in taxes would drop her income enough that she would not owe money. Beginning January 1 2021 the HFWA will require employers with 16 or more employees to provide full-time employees with up to 48 hours of paid sick leave per year. Employers have the right to make certain restrictions in.

Summary of Colorado Military and Veterans Benefits. Perez South Dakota Governor Dennis Daugaard and Delaware Governor Jack Markell signed letters to the Governors of States and US. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Additionally employees of religious organizations or associations except such organizations or associations. The State of Colorado offers special benefits for its military Service members and Veterans including Retired Military Pay and Property tax exemptions state employment preferences education and tuition assistance vehicle tags as well as hunting and fishing license privileges. And if that fails she would qualify for the 1400 non-taxable payments to.

These exemptions expire when the next vaccines are due or when the child enrolls in kindergarten. Equal Opportunity Commission has more information on this on their website. The exclusion of employer-provided adoption benefits Form 8839 Tuition and fees deduction Form 8917 The deduction of up to 25000 for active participation in a passive rental real estate activity Form 8582 If you have already filed your 2020 Form 1040 or 1040-SR you should not file an amended return.

Colorado Motor Vehicle Exemption. 13-54-102 - Bicycles and motor vehicles that are used to travel to work up to 7500 up to 12500 if used by the elderly or debtor or dependent with a disability. In that case the court upheld an employers policy stating that employees.

1000 per net new employee For the first two years that a business is in an enterprise zone the business can earn 1000 per net new employee insured under a qualified health plan for which the employer pays at least 50 of the cost. Simply not wanting the vaccine is not an option.

Performance Review Template Farm Manager Performance Reviews Employee Performance Review Performance Evaluation

W10 Form 10 What Will W10 Form 10 Be Like In The Next 10 Years Rental Agreement Templates Tax Forms Doctors Note Template

Letters Of Appreciation Templates Luxury Appreciation Letter Employees For A Job Well Done Thank You Letter Template Letter Template For Kids Lettering

30 Co S Saying No To Remote Jobs In Colorado Ongig Blog

Https Nyess Ny Gov Docs Employment First March2015 Final Pdf

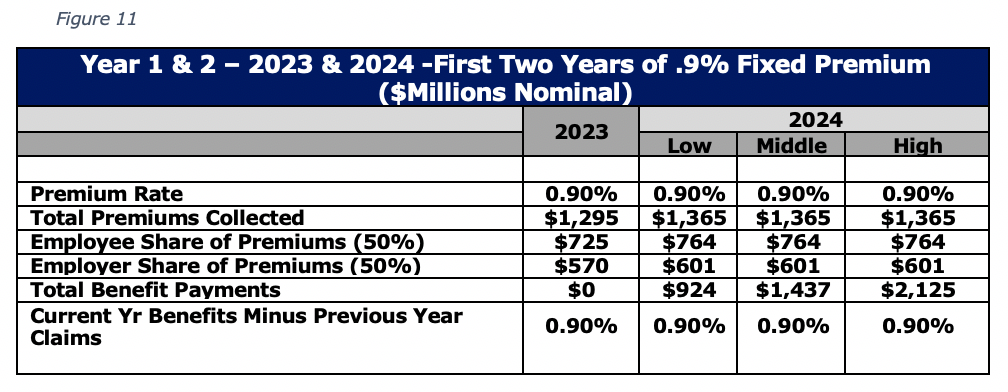

Proposition 118 A Statewide Paid Family And Medical Leave Program For Colorado But At What Cost Common Sense Institute

The Traditional Progressive Discipline Paradigm

Http Scholar Law Colorado Edu Cgi Viewcontent Cgi Article 1018 Context Articles

New Employee Forms A Checklist For Small Businesses The Blueprint

Employee Benefits Human Resources

We Deals With Tax Services In Queens Ny So If Tax Payers Wants To Pay Their Professional Tax Services Queens Ny Then The Tax Questions Filing Taxes Income Tax

Sample Career Change Cover Letter Elegant 25 New Nhance Cost Project Manager Resume Resume Skills Human Resources Resume

Covid 19 Personnel And Procurement Information Dhr

Military Tax Tips Tricks Filing Benefits Tax Write Offs Filing Taxes Tax Time

Colorado Employment First Colorado Department Of Human Services

Ep294 Is A Heloc Still Tax Deductible Morris Invest Tax Deductions Heloc Investing

Posting Komentar untuk "Colorado Employment First Exemptions"